EXTERNAL REVIEW GUIDELINE

It is recommended that the issuers to appoint external reviewer to confirm their green finance programme is aligned with the following 4 key components defined in the Green Bond Principle and Green Loan Principle:

Use of Proceeds

- Process for Project Evaluation and Selection

- Management of Proceeds

- Reporting

When structuring the green finance debt instrument , issuers can seek external opinions from different channels (such as organizations with recognized expertise in green finance) in order to provide following types of external review:

Issuers can apply certification for their Green Bonds or Green Loans, Green Finance Frameworks and potential eligible green projects are assessed against national / international green standards and certification requirements. Below are two of the third party certification bodies which provide green finance certification schemes.

International

- Establishing a transparent and effective green bond market

- Developing Climate Bond Standard and Certification Service

- Identify investments that have valuable contributions

- Provide credit guarantees for green financial products

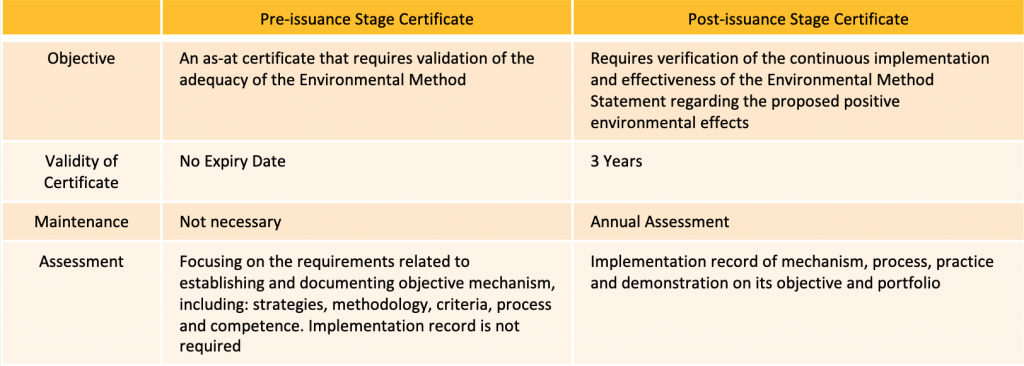

- Issuer needs to conduct independent verification before and after bond issuance in order to ensure the bond meets the requirements of the climate bond standard. The process is as below:

- Prepare the bond

- Identify assets that meet the relevant sector criteria and prepare the supporting document

- Create Green Bond Framework to list out the use of proceeds

- Engage a verifier

- Engage an approved verifier for Pre- and Post- Issuance Certification

- Provide related documents to verifier

- Receive a verifier’s report, giving assurance that Climate Bonds Standard requirements are met

- Get certified and Issue a Certified Climate Bond

- Submit the verifier’s report and information to Climate Bonds Initiative

- Receive a decision on Pre-issuance Certification

- Issue the bond, using the Certified Climate Bond mark

- Confirm the Certification Post-Issuance

- Submit the Verifiers Post Issuance Report within 24 months of issuance

- Receive notification of Post-Issuance Certification

- Report annually

- Prepare a simple report to bond holders and Climate Bonds Initiative each year

- Provide updates through public disclosure

Hong Kong

-

- Exploring new commercial and business opportunities in the Green Finance Market

- Promoting Green Finance

- Fostering environmentally-friendly investments and facilitate the development of Green Finance and Green Industry

- Green and Sustainable Finance Certification Scheme Development

-

- Attracting potential investors

- Demonstrating issuers’ effort in promoting environmentally-friendly investment

- Promoting Green Finance

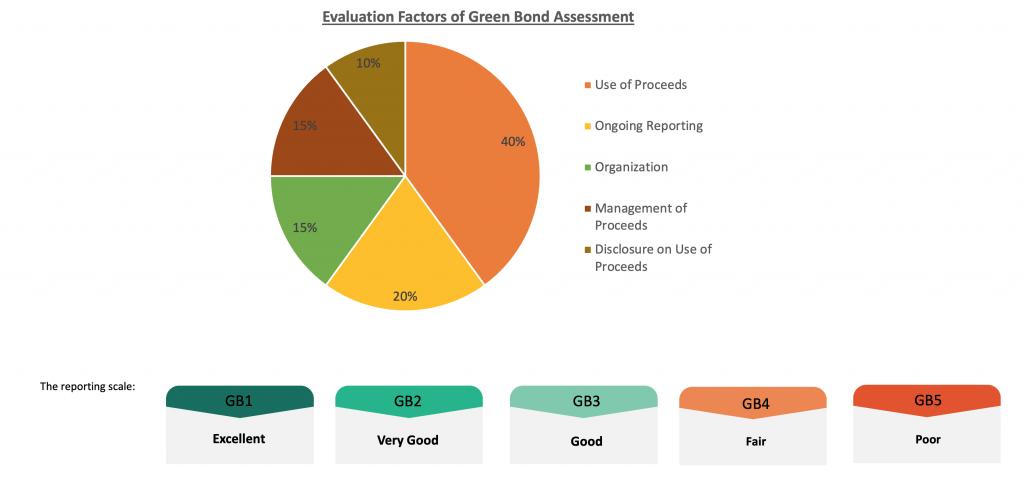

- Types of Certification: