- Deals with the capital structure of an enterprise, such as funding and investment

- Prioritizes and distributes financial resources to maximize the value of a company

- Expands business in an effective way

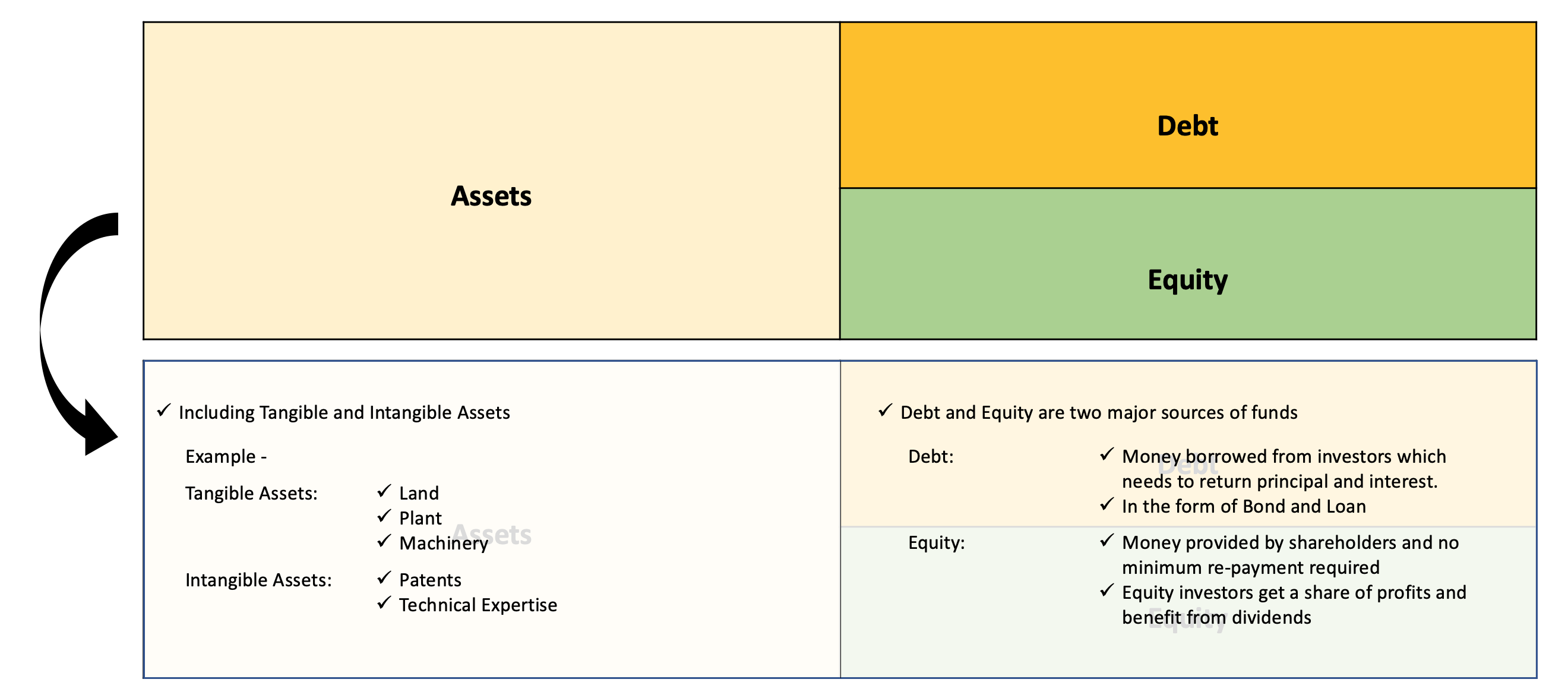

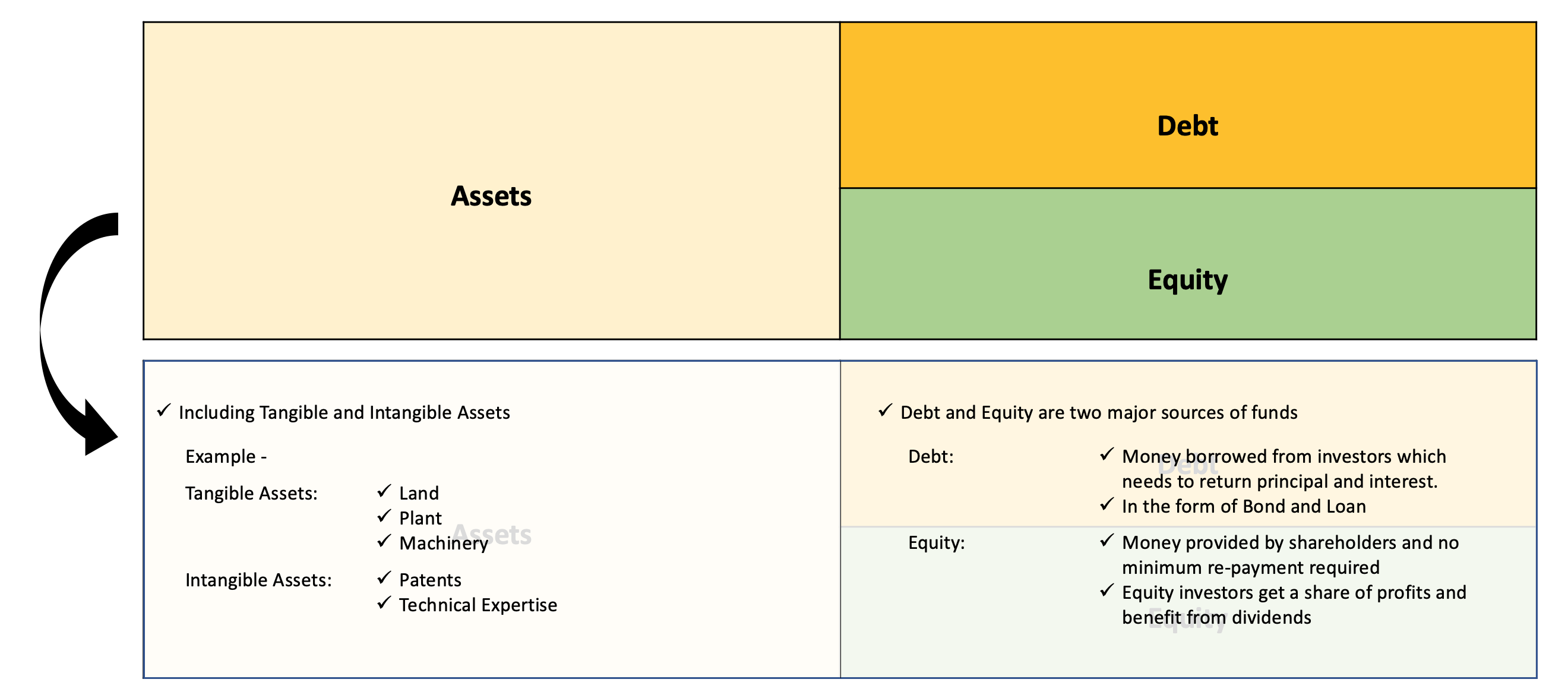

The capital structure of a company (example below) determines how well balanced a company’s capital financing is. If a company is heavily funded by debt, it will be considered to have an aggressive capital structure.

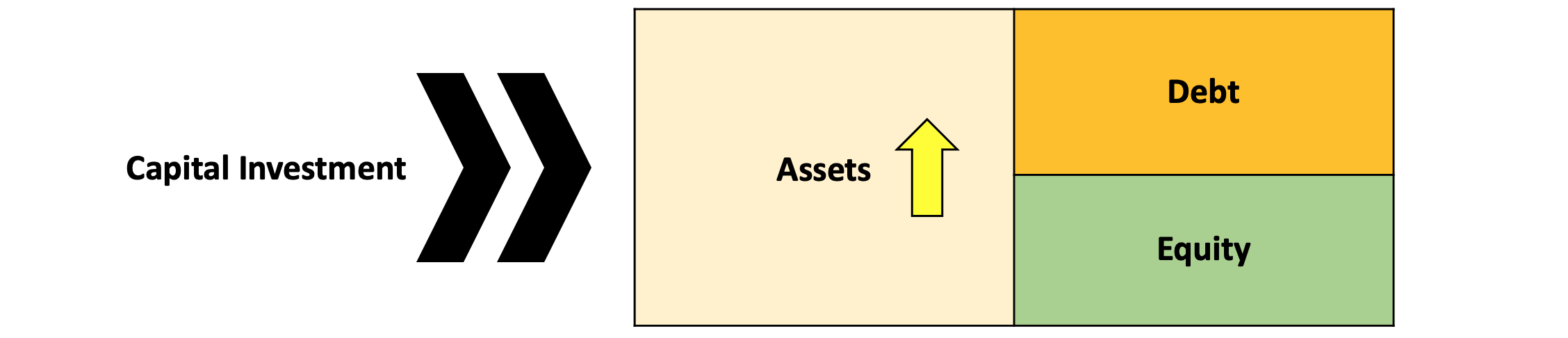

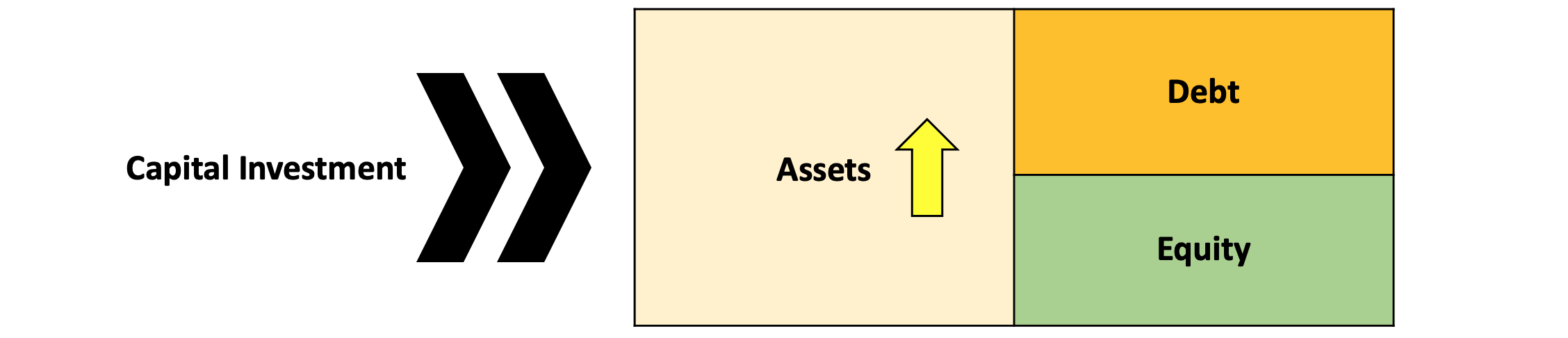

Capital Investment will increase the assets of a company.

The evaluation of Capital Investment is based on:

Net Present Value (NPV)

- Measuring the difference between the present value of cash inflows and outflows over a period of time

- Analyzing a projected investment’s profitability

Internal Rate of Return (IRR)

- Measuring the annual rate of growth that is expected to be generated on an investment

- Estimating the profitability of potential investment

For investments with positive environmental or social impact, it might be classified as Impact Investing

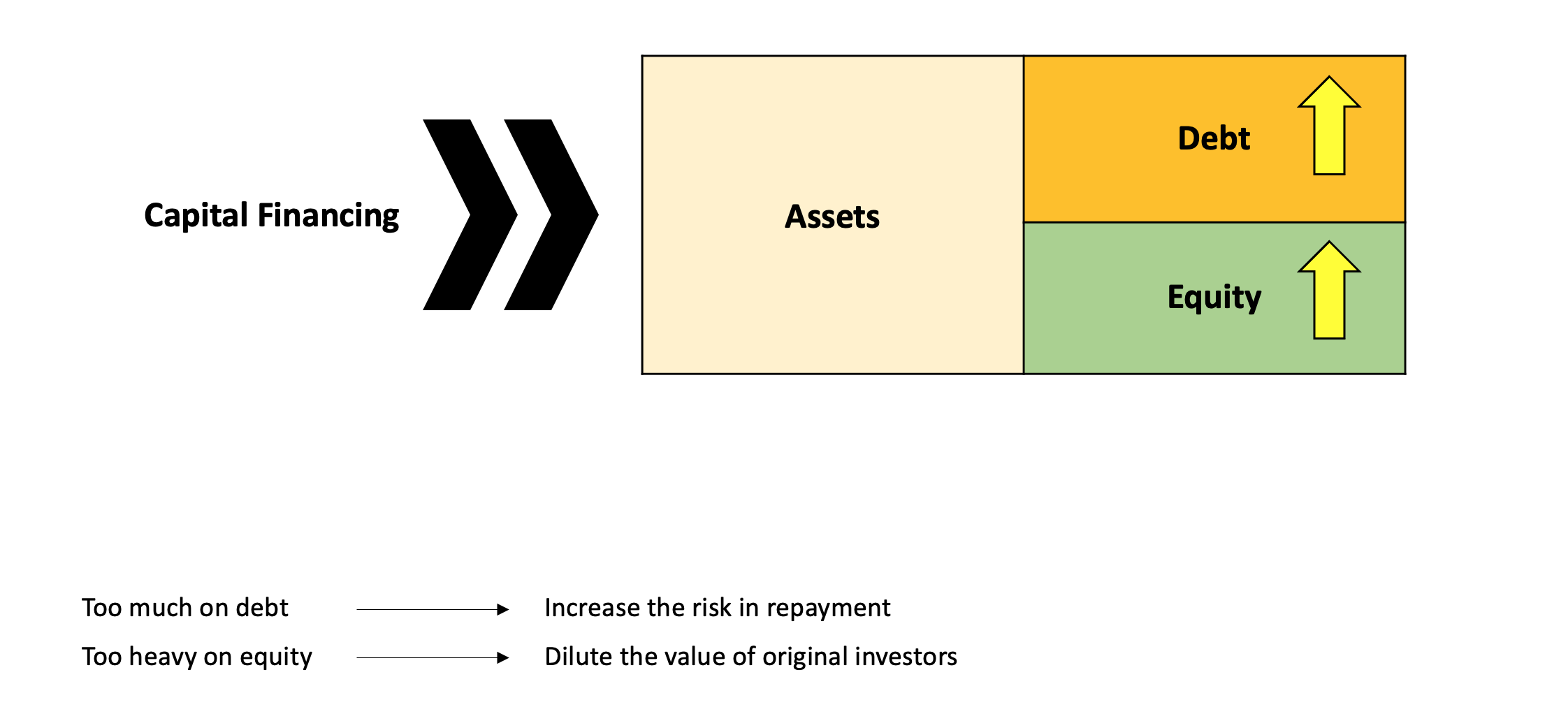

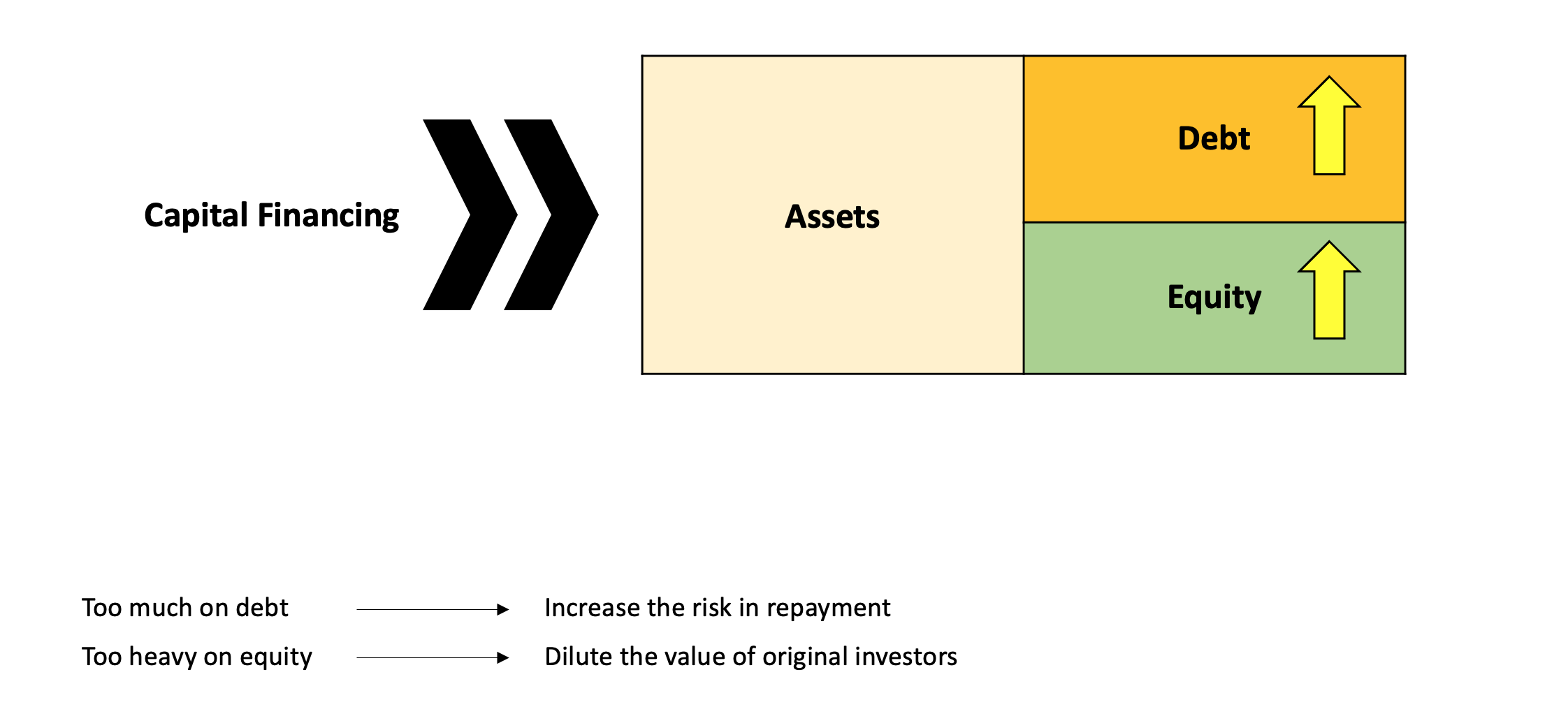

Capital Financing will increase the liability or equity of an enterprise.

The decision on debt versus equity relies on:

- Current Economic Climate

- Existing Capital Structure

- Existing Status of the Enterprise’s Life Cycle

The balance between debt and equity:

- Too much on debt ⟶ Increase the risk in repayment

- Too heavy on equity ⟶ Dilute the value of original investors

Issuing Green Bond or Borrowing Green Loan might be one of the possible ways to acquire funding

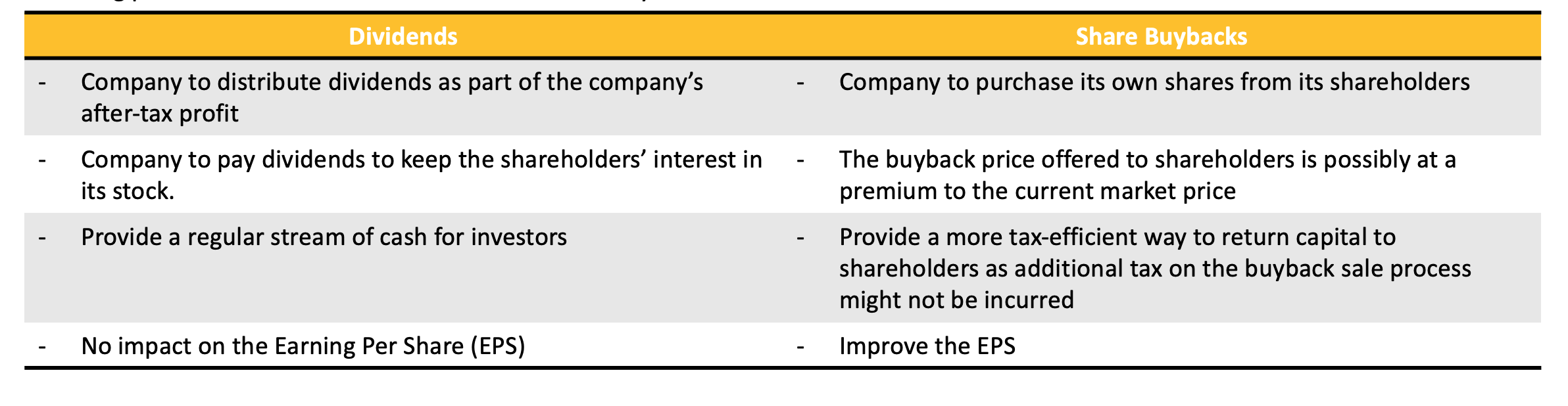

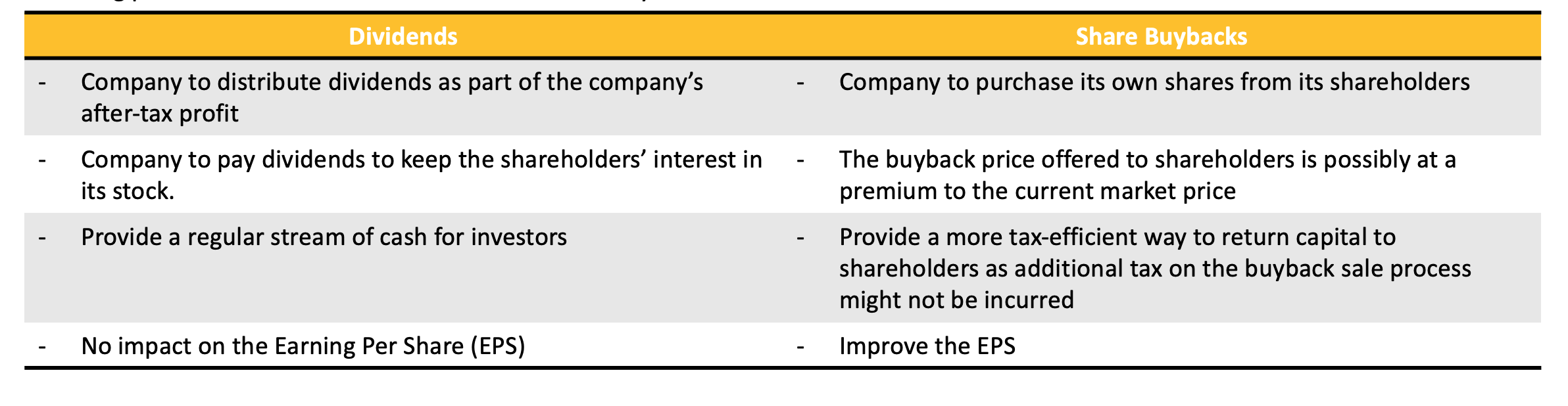

The management of an enterprise make the decision to:

- Distribute the earnings to shareholders in the form of dividends or share buybacks

- Retain the excess earnings for future investments and operational requirements

Returning profits to shareholders – Dividends or Share Buybacks