Publication Period

Independent Assurance

The reporting principles consists of 4 main elements: Materiality, Quantitative, Balance and Consistency.

1. Materiality. The threshold at which ESG issues determined by the board are sufficiently important to investors and other stakeholders that they should be reported.

2. Quantitative. KPIs in respect of historical data need to be measurable. The issuer should set targets (which may be actual numerical figures or directional, forward-looking statements) to reduce a particular impact. In this way the effectiveness of ESG policies and management system can be evaluated and validated. Quantitative information should be accompanied by a narrative, explaining its purpose, impacts, and giving comparative data where appropriate.

3. Balance. The ESG report should provide an unbiased picture of the issuer’s performance. The report should avoid selections, omissions, or presentation formats that may inappropriately influence a decision or judgement by the report reader.

4. Consistency. The issuer should use consistent methodologies to allow for meaningful comparisons of ESG data over time.

In Appendix 27 Environmental, Social and Governance Reporting Guide, it contains 2 levels of disclosure obligations: Mandatory Disclosure and “Comply or Explain” Provisions.

1. Mandatory Disclosure

Governance Structure

The following elements should be included in the statement from the board:

Reporting Principle

Materiality –

The following information should be disclosed in the ESG report:

Quantitative –

The standards, methodologies, assumptions and calculation tools used and the source of conversion factors used for the reporting of emissions or energy consumption.

Consistency –

Any changes to the methods or KPIs used or any other relevant factors affecting the meaningful comparison.

Reporting Boundary

Explaining the reporting boundaries of the ESG report and describing the process used to identify which entities or operations are included in the ESG report. The issuer needs to explain the difference and reason for the scope change as well (if any).

2. “Comply or Explain” Provision

Environmental

Focus on four aspect Emissions, Use of Resources, The Environment and Natural Resources, Climate Change with the different KPIs:

Aspect 1: Emissions

he information on policies and compliance with relevant laws and regulations that have significant impact on the issuer relating to air and greenhouse gas emissions, discharges into water and land, and generation of hazardous and non-hazardous waste.

Remarks:

| KPI | Description |

|---|---|

| 1 | The types of emissions and respective emissions data |

| 2 | Direct or energy indirect greenhouse gas emissions (in tonnes) and, where appropriate, intensity (e.g. per unit of production volume, per facility) |

| 3 | Total hazardous waste produced (in tonnes) and, where appropriate, intensity (e.g. per unit of production volume, per facility) |

| 4 | Total non-hazardous waste produced (in tonnes) and, where appropriate, intensity (e.g. per unit of production volume, per facility) |

| 5 | Description of emission target(s) set and steps taken to achieve them |

| 6 | Description of how hazardous and non-hazardous wastes are handled, and a description of reduction target(s) set and steps taken to achieve them |

Aspect 2: Use of Resources

The information on policies on the efficient use of resources, including energy, water and other raw materials.

Remarks:

| KPI | Description |

|---|---|

| 1 | Direct and/or indirect energy consumption by type (e.g. electricity, gas or oil) in total (kWh in ’000s) and intensity (e.g. per unit of production volume, per facility) |

| 2 | Water consumption in total and intensity (e.g. per unit of production volume, per facility). |

| 3 | Description of energy use efficiency target(s) set and steps taken to achieve them |

| 4 | Description of whether there is any issue in sourcing water that is fit for purpose, water efficiency target(s) set and steps taken to achieve them |

| 5 | Total packaging material used for finished products (in tonnes) and, if applicable, with reference to per unit produced |

Aspect 3: The Environment and Natural Resources

The information on policies on minimizing the issuer’s significant impacts on the environment and natural resources.

| KPI | Description |

|---|---|

| 1 | Description of the significant impacts of activities on the environment and natural resources and the actions taken to manage them |

Aspect 4: Climate Change

The information on policies on identification and mitigation of significant climate-related issues which have impacted, and those which may impact, the issuer.

| KPI | Description |

|---|---|

| 1 | Description of the significant climate-related issues which have impacted, and those which may impact, the issuer, and the actions taken to manage them. |

Social

Focus on Employment and Labour Practices, Operating Practices and Community with the following aspects:

| Employment and Labour Practices | Operating Practices | Community |

|---|---|---|

| EmploymentHealth and SafetyDevelopment and TrainingLabour Standard | Supply Chain ManagementProduct ResponsibilityAnti-Corruption | Community Investment |

Governance

According to Appendix 14 Corporate Governance Code and Corporate Governance Report2. issuer must include the mandatory disclosure in the annual report for transparency provision.

| Mandatory Disclosure | Corporate Governance PracticesDirectors’ Securities TransactionsBoard of DirectorsChairman and Chief ExecutiveNon-Executive DirectorsBoard CommitteesAuditor’s RemunerationCompany SecretaryShareholders’ RightInvestor Relations Any significant changes in the issuer’s constitutional documents during the year.Risk Management and Internal Control |

|---|

The issuer is encouraged to disclose the following information (recommended disclosure) in the report. The level of detail needed varies with the nature and complexity of issuer’s business activities.

| Recommended Disclosure | Share Interest of Senior ManagementInvestor Relations Details of shareholders by type and aggregate shareholding;Details of the last shareholders’ meeting, including the time and venue, major items discussed and voting particulars;Indication of important shareholders’ dates in the coming financial year; andPublic float capitalization at the year endManagement Function |

|---|

In May 2019, Mr. Norman Chan, Chief Executive of The Hong Kong Monetary Authority (HKMA) announced a measure “Green and Sustainable Banking” to support and promote green finance development in Hong Kong.

The promotion of Green and Sustainable Banking involves 3 phases2 as below which helps HKMA to understand the readiness of authorized institutions in adopting green and sustainable banking, monitor the development progress and expedite the formulation of supervisory requirements.

The 3-phased approach is meant to be an iterative and evolving process, the assessment framework will be adjusted from time to time according to authorized institutions’ opinions and the latest development.

Phase I

To develop a framework to assess “Greenness Baseline” of individual banks and collaborate with relevant international bodies to provide technical support to banks in Hong Kong for their better understanding of green principles and methodology in undertaking the baseline assessment.

Phase II

To consult industry and other relevant stakeholders on the expectation and requirement of Green and Sustainable Banking and set targets to enhance the green and sustainable developments of the Hong Kong banking industry.

Phase III

To implement, review and evaluate the bank’s progress in this regard.

HKMA aims to develop a common framework with a group of major industry stakeholders to measure the “Greenness Baseline” of authorized institutions. The framework consists both guiding principles and possible metrics or greenness assessment, such principles and metrics will be developed by considering the opinions from local stakeholders as well as international guidelines and recommended practices. Besides, HKMA has also joined the Central Banks and Supervisors Network for Greening the Financial System (NGFS) in order to get international insights on framework development.Framework Development

In July 2019, HKMA formed a working group with representatives from 22 different authorized institutions including first movers and beginners in green banking for framework development.Framework Overview

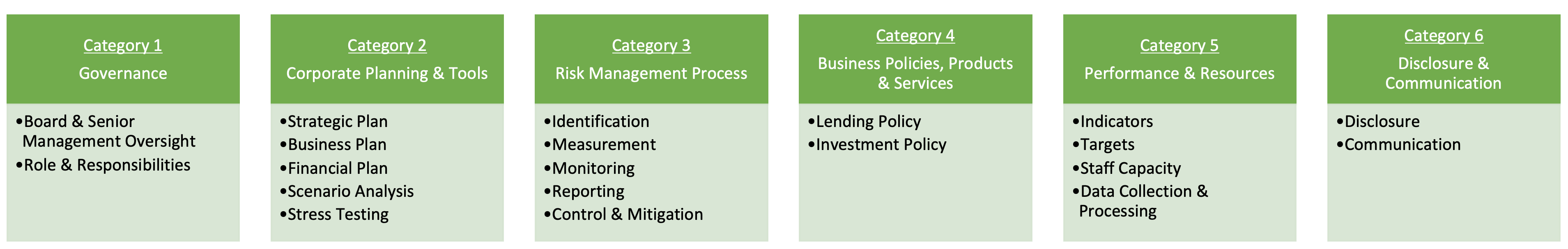

The framework collects information based on 20 elements under 6 categories which covers the development in preparations for managing climate and environmental risks by authorized institutions.

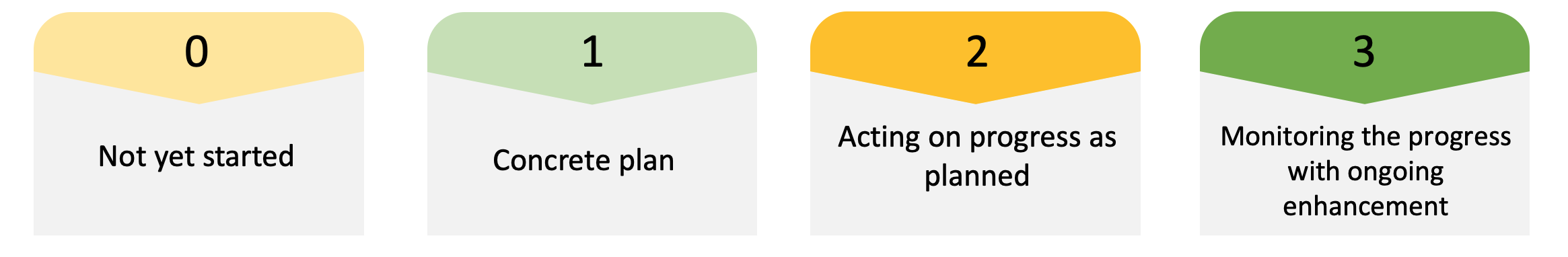

Authorized institutions can conduct self-assessment that focuses on the financial risks (such as credit risk and market risk) associated with climate and environmental issues. By reporting the development level of each element, on a scale from 0 to 3 with the meaning of each stage shown below, the progress on certain elements can be demonstrated.

Key Considerations in Framework Development

The initial focus is on authorized institutions’ banking activities, including lending and proprietary investment activities. When authorized institutions achieve further progress in developing green and sustainable banking, the types of business activities covered in the assessment will be further reviewed and adjusted from time to time. Suggestions and comments from the banking industry have also and always been a key consideration in the framework development.Preliminary Result of the First Assessment

47 authorized institutions were selected to take part in the first round of assessments in August 2020. Here are two of the preliminary observations:General Observation

The result indicates that large and international authorized institutions tend to take lead in this area, this may due to benefiting from group policy or the requirements of their home supervisors.Development in Addressing Climate Risks & Environmental Risks

The table below shows the differences in development between climate risks and environmental risks from the preliminary results:

More preliminary results can be viewed here. Through the assessment, HKMA can work with the industry to improve the gaps and challenges identified, the authorized institutions can also formulate their strategies and approaches to address climate and environmental risks.

In Phase II, HKMA focuses on the development of supervisory expectation which helps authorized institutions to set up plans on green and sustainable banking development.

HKMA has published a White Paper on Green and Sustainable Banking in June 2020 introducing their initial ideas on supervisory expectations. The idea can be summarized in 9 guiding principles5 which helps authorized institutions to develop strategy and framework to cope with risks and opportunities brought by climate change.

HKMA has also issued a circular in July 2020 which provides a range of practices that the more advanced authorized institutions have adopted or planned to adopt in managing climate risks.

General Assessment & Supervisory Requirements

In order to have a better understanding of the common practices adopted by different authorized institutions and set up better supervisory requirements, HKMA aims to:

Collaboration

The Green and Sustainable Finance Cross-Agency Steering Group (Steering Group) is formed by HKMA and the Securities and Futures Commission (SFC) in May 2020. The Steering Group will –

In order to promote the growth of green and sustainable finance in Hong Kong